Valuation of Bitcoin using to the Elaboration likelihood model (ELM), Peripheral route

How much are you prepared to pay for one Bitcoin? The current market value is at approximately USD 1000 (Mt. Gox).

This is more than five times the value compared to when I handed in my dissertation a mere 6 weeks ago! Why this movement in price? Why are more people willing to accept/trust Bitcoin as a method of payment? Using theories discussed in a recent lecture by Wharton’s Professor Kahn in Coursera.org’s marketing course we look at a pertinent overarching framework affecting the human notion of decision making: the Elaboration likelihood model (ELM).

The ELM, originally devised by Petty and Cacioppo (1986) and later adapted by Kim and Tadisina (2005) to the on-line environment, is a model of two paths: peripheral; and central; which affect how people form trust and in this instance affects the valuation of Bitcoin.

Path 1. Central-route processes requires the individual to think about they trust they bestow on Bitcoin. The trustor must evaluate and analyse the external messages and market signals, if favourable, trust is earned which denotes more value assigned to Bitcoin. For this route to be utilised, a person must have the ability and motivation to do so.

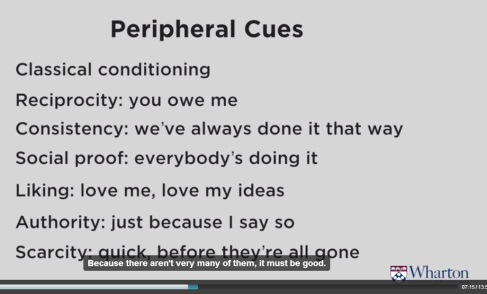

Path 2. Peripheral-route processes, on the other hand, is based on the perceived credibility of the source, message quality, a catchy slogan, or frequency seen (such are common tactics of marketers). It is based on external cues rather than thought so is subject to mass movements in market sentiment.

It is proposed that when users have little to no experience with dealing with a technology they rely on the peripheral route. As the customers’ experience matures it may push their formation of trust down the central path. If we take into account the low value of Bitcoin in the past; the niche interest in it; and the short time it has been around we can assume that there are not many experts in Bitcoin and that the current movements are caused by people going down the peripheral route of the ELM. Therefore I refer to a slide from the Wharton lecture:

I would suggest that recent activities, news, and the structure of Bitcoin itself fulfil many of these cues and is why people are persuaded into thinking it’s a good idea to trust and thus inflate the value of Bitcoin.

Looking at this list in reverse order:

Scarcity: The Bitcoin.org website testifies that “the number of new bitcoins created each year is automatically halved over time until bitcoin issuance halts completely with a total of 21 million bitcoins in existence” (http://bitcoin.org/en/faq#how-are-bitcoins-created). This limited amount creates scarcity thus influencing the buy decision.

Authority: Recent headlines read “…US lends legitimacy to virtual currencies…” (http://rt.com/usa/bitcoin-legitimate-senate-hearing-931/) and with more and more vendors accepting Bitcoins for goods and services we can acknowledge another peripheral cue.

Liking: Different people like different things, so be it the: decentralised; “anonymous”; idealistic; quick-transfer; free-transfer; or cryptological nature of Bitcoin there is something for everyone to like. Not forgetting the five times return on investment in a mere 6 weeks mentioned earlier!

Social Proof: This cue has the tag-line of “everybody’s doing it” on the Wharton lecture slide and that’s exactly what seems to be the current case with Bitcoin.

Consistency: It is somewhat tougher to sway individual’s judgement with Bitcoin’s consistency due to its volatile pricing history. Yet it is consistent in human behaviour to follow the crowd whether it is bullish or not. Currently the sentiment is jittery due to price fluctuations yet the trend for number of trades is increasing (http://blockchain.info/charts/n-transactions?timespan=all&showDataPoints=false&daysAverageString=1&show_header=true&scale=0&address=). Although Bitcoin does not offer the consistency to establish this quick peripheral cue trading trends indicate that Bitcoin is a currency that is ready to take-off… either that or investors are blindly following market sentiment, afraid to miss the boat (social proof cue).

Reciprocity: With traditional fiat currencies it would be difficult to argue the feeling of reciprocity when buying a currency. Yet with the Bitcoin infrastructure reliant on the network of computers to hash out transactions the investor can be part of this network. I’m not saying it is a large factor but with the lottery format of Bitcoin mining there is an added feeling of receiving from the Bitcoin system.

Just one of these cues are enough to resonate with individuals and Bitcoin happens to hit at least the first four. Perhaps there is even more to the genius of Bitcoin than first meets the eye.

Petty, R.E. & Cacioppo, J.T. (1986). The Elaboration Likelihood Model of persuasion. New York: Academic Press.

Kim, E. and Tadisina, S., 2005. Factors Impacting Customers’ Initial Trust in E-Business: An Empirical Study. In Proceedings on the 38th Hawaii International Conference on System Sciences, January 3-6, Waikoloa, Hawaii.

Insights on e-Transaction Start-ups: Bitwall.io- lacking customer centricity

The absence of transaction fees apparent on most e-currencies have brought about companies such as http://www.bitwall.io who propose a financial transaction service to “unlock the Internet’s monetization potential”.

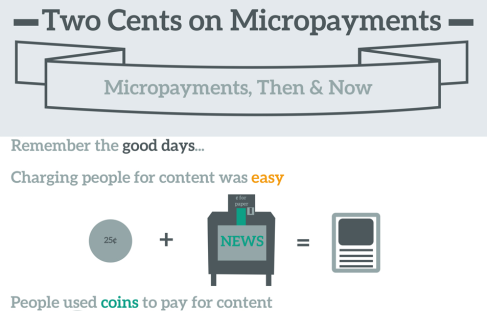

Bitwall.io compare their service to the “good days” of vending: 25 cents for a singular item (see below).

But things have moved on since the “good days” and by looking at this business using a common marketing technique: segmentation by demographic we can ask the question: How does (micro)charging for on-line content match the general demographic of today’s internet users? also what customer segment would they attract?

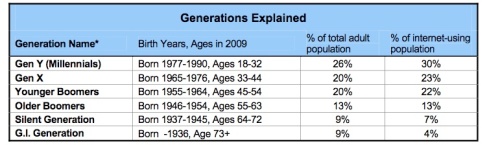

Barbara Kahn professor at The Wharton School, Penn. commented in a marketing lecture on coursera.org (2013) that Generation Y (Millennials) demonstrate affinity for free on-line material as a general trait.

This suggests that in general paying for on-line material and hence Bitwall’s business model may face challenges in securing in customers born between 1980-2000 which is unfortunately the proportion of the population that spends the most time on the internet (Ipsos Media, October 2011).

On the other hand the perception of paying “next to nothing” may be just as good as being free. This means that Millennials may very well pay for a product/ app/ article as they may see 25 cents as worthless pocket-change (but this raises the questions, why is pocket-change perceived as next to nothing, is this due to the fact it is in the form of coins? how does the proliferation of e-transactions affect the amount of coin change generated? would amalgamating this change in an account affect the perceived value of each cent?). Further market research can be performed to gauge this range and I think it is important to research what are the characteristics of an on-line product that customers are willing to pay for to see if Bitwall.io are offering service that people will actually use.

With this insight of internet users Bitwall.io can adjust their customer value proposition to make their service more attractive. Bitwall.io may even start a service using blue ocean strategy, it is very possible that there are dollars to be earned by products with unique characteristics that no-one else has exploited yet.

So ruling out the Millennials, what portion of internet-users remember the “good days” of paying for newspapers?

http://www.psfk.com/2009/02/us-report-internet-usage-by-age.html

According to the psfk (2009) table above 70% of the internet using population in the US grew up in an era before internet news. This is definitely a large market but it is pertinent to question whether this 70% are willing to return to paying for little things like the on-line equivalent of newspapers. If we do compare this to the “good days” 25 cents for a newspaper of approximately 200,000 words is a great deal… I’m not sure if current publishing houses are saying if they are offering the same number of words for 25 cents. I speculate that internet articles are under 2,000 words and if it is charged at 25 cents it is not a fantastic deal.

Therefore, the lack of clarity on the end product along with lack of research makes it hard to know who the market are and how the market of tomorrow will take to micro-transactions of this manner. It is up to the companies producing the material to convince the customer to part with money regularly and to find what customers are willing to pay a premium for. Another way to approach this situation is to find the price-point which customers believe to be fair value.

These latter issues have little to do with companies like Bitwall.io who are concerned with the financial transition logistics. Bitwall.io may already have research pertaining to the future of this market for transactions of this size. It is a bold move to start up a company with such uncertain prospects but the low-costs do somewhat mitigate the high-risk. What Bitwall.io are doing is common practice in the start-up community today, I’m not referring to the actual business but the nature of taking a mediocre, poorly-researched idea and building a website which fingers-crossed with generate enough interest for a 6-figure buy-out.

One final thing, we have postulated that Millennials would not be as big users of this service as other older generations. So while it is edgy for designers to use Millennial-friendly web design and currently popular Avengers themes (see below) is it really appropriate for capturing the non- Millennial target market? It is thus my opinion Bitwall.io are actually targeting the young trend-watchers of the likes of Google in anticipation of a buyout and not really committed to providing a service to a market segment they have no research or customer relations with.

Current Bitwall.io theme: Avengers